Deloitte – Przewidywania w sektorze TMT na 2020 i dalej

Deloitte opublikował nowy raport (link do pdf), polecam przeczytać całość. Tutaj postarałem się przekleić kilka głównych wniosków i elementów, czasami z opisem, czasami oryginalnie po angielsku.

Coraz więcej AI w chipsetach w telefonie i na bliżej rozwiązań (Edge AI chips come into their own )

Obecnie do 7% chipsetu w telefonie zajmuje element AI.

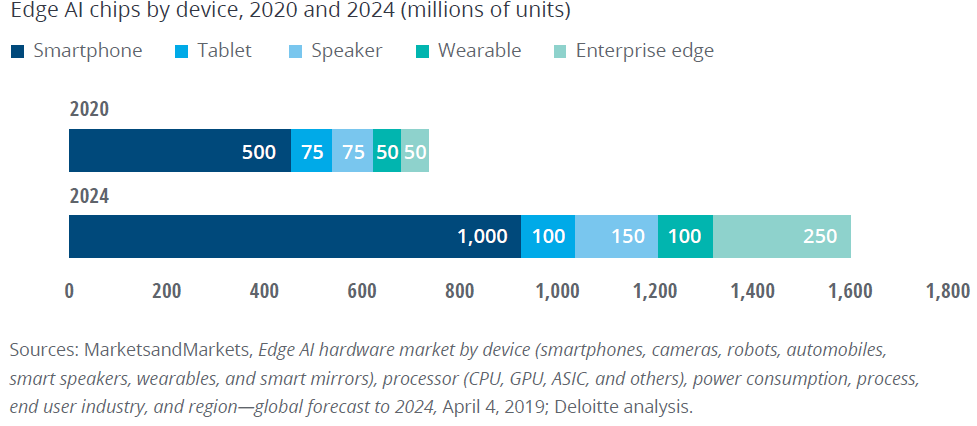

By 2024, we expect sales of edge AI chips to exceed 1.5 billion, possibly by a great deal. This represents

annual unit sales growth of at least 20 percent, more than double the longerterm forecast of 9 percent

CAGR for the overall semiconductor industry.

In 2020, the consumer device market will likely represent more than 90 percent of the edge AI chip

market, both in terms of the numbers sold and their dollar value. The vast majority of these edge

AI chips will go into high-end smartphones, which account for more than 70 percent of all consumer

edge AI chips currently in use.

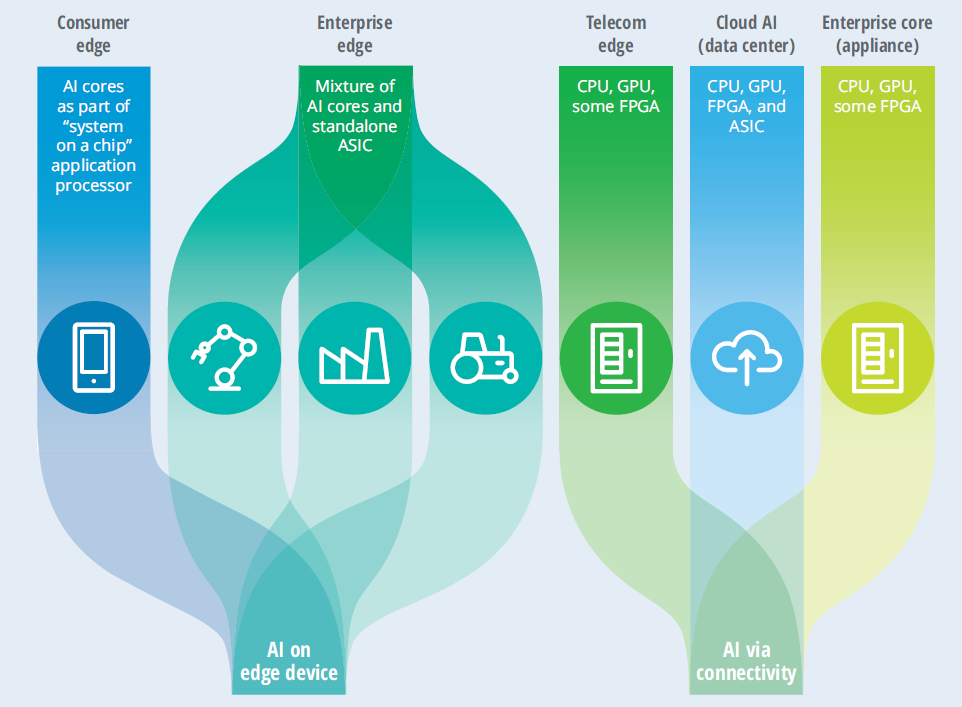

AI computing can occur at different physical locations

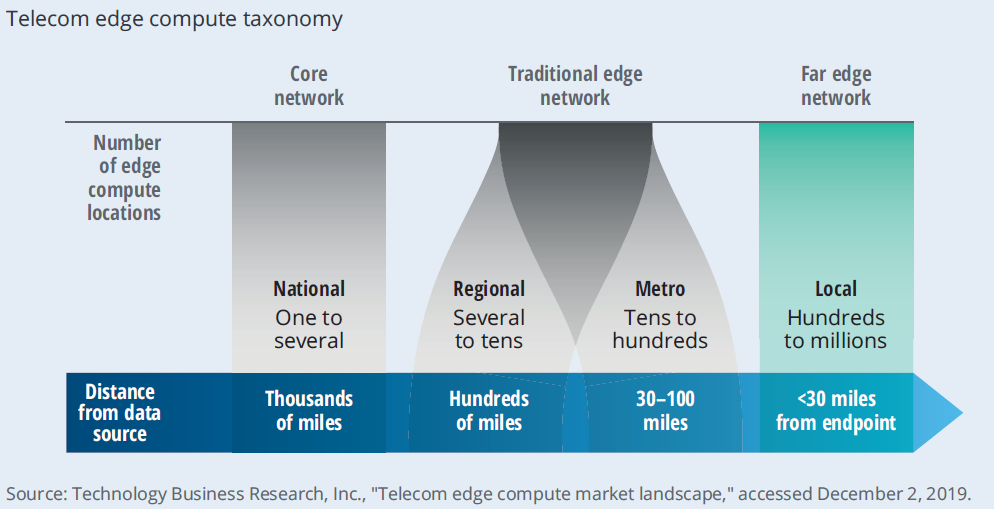

Telecom edge compute, or the “far edge network,” brings computing to within 30 miles of its data source

The edge AI chip industry is poised for growth

WHAT DO EDGE AI CHIPS DO?

Perhaps the better question is, what don’t they do? Machine learning today underlies all sorts of

capabilities, including but not limited to, biometrics, facial detection and recognition, anything to

do with augmented and virtual reality, fun image filters, voice recognition, language translation,

voice assistance … and photos, photos, photos. From hiding our wrinkles to applying 3D effects

to enabling incredibly low-light photography, edge AI hardware and software—not the lens or the

sensor’s number of megapixels—are now what differentiates the best smartphone cameras from

the rest.

Companies that manufacture smartphones (and other device types) can take different approaches

to obtaining edge AI chips, with the decision driven by factors including phone model and

(sometimes) geography.

Samsung – 5% for AI, Apple – 7 % for AI, Huawei -2,7 for AI

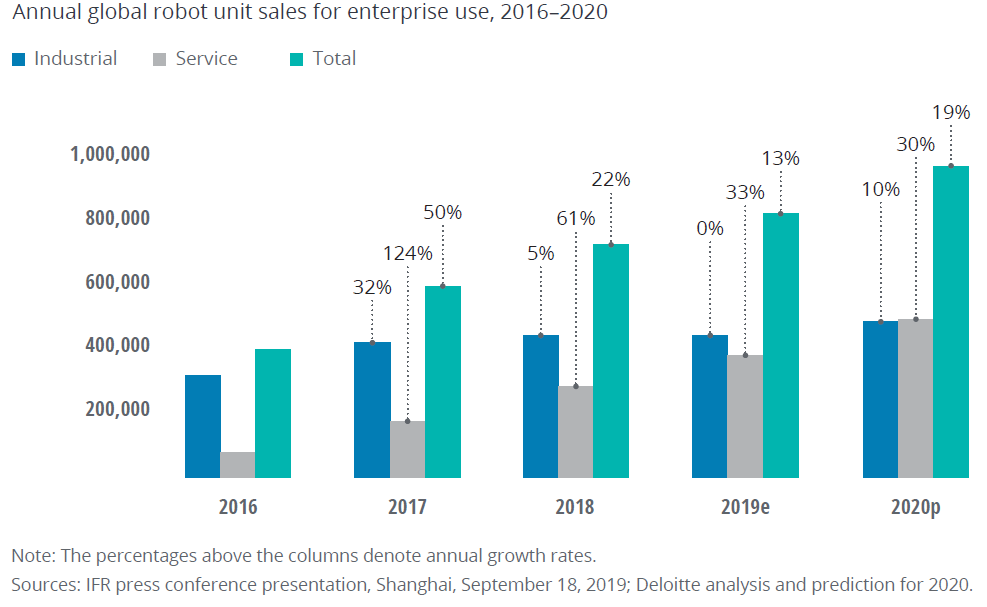

Robots on the move: Professional service robots set for double-digit growth

The professional service robot market, while smaller, is growing much faster than the industrial robot market

Czym się różni robot przemysłowy od profesjonalnych usług?

Industrial robots have been around since the 1970s. The archetypal industrial robot is the mechanical arm, with varying levels of freedom and flexibility, found in factories around the world. The biggest users (in descending order) of industrial robots are the automotive, electrical/electronics, metal, plastics and chemicals, and food and beverage verticals within the manufacturing industry.

Professional service robots are more recent, with the market only really taking off within the last decade. In contrast to industrial robots, professional service robots are mainly used outside of manufacturing, and they usually assist humans rather than replace them. Most are designed with wheels to make them mobile or semimobile. Professional service robots have been most popular in the retail, hospitality, health care, and logistics (in warehouse or fulfillment settings) industries, although some are also used in space and defense, agriculture, and demolition.

We expect revenues from industrial robot sales in 2020 to reach nearly US$18 billion, a 9 percent increase over 2019.

China is the largest market for industrial robots: 154,000 industrial robots were sold in China in 2018, accounting for 36 percent of global industrial robot demand. This is nearly three times as many as were sold in Japan, the second-largest market, and nearly four times as many as in the United States and South Korea, the third- and fourth-largest markets.

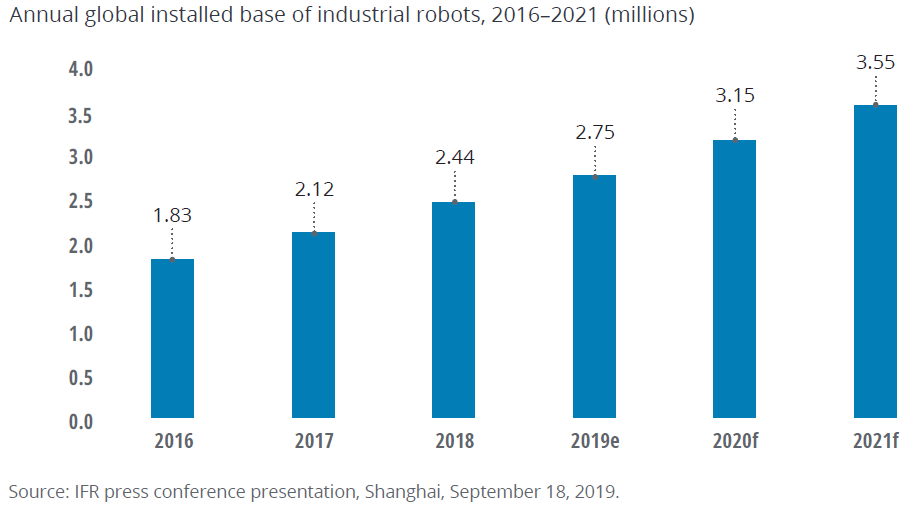

Nearly four million industrial robots are expected to be in use by 2021

Robotyzacja nie oznacza robotów ale i algorytmy.

Alarmist projections—such as a 2015 forecast from the Bank of England that the United Kingdom would lose 15 million jobs to robots, or a 2018 Brookings study stating that one-quarter of all US jobs were at high risk of automation, or the World Bank’s 2017 estimate that robots would take over 600 million jobs globally by 2032—are widely reported, and can conjure up scenarios of robots running rampant in the near future. In reality, reports of these estimates usually select their numbers from the higher (more alarming) end, and the projections themselves encompass not only actual physical robots (both industrial and professional service) but also tools such as AI and robotic process automation. Most people, if told how fast the industrial robot industry is growing, might find the 10 percent figure for 2020 to be much lower than their expectations … or fears.

Rośnie liczba In 2017, the International Federation of Robotics report predicted that in 2020, for the first time in history, global industrial robot sales would reach more half a million units (550,000, to be exact)—more than double the 254,000 units sold in 2015.

Profesjonalne roboty.

Only about 100,000 professional service robots worldwide were probably in use as of 2015 and global professional service robot sales in 2016 were a mere 100,000 units. On such a small base, achieving double-digit growth from 2017 to 2019 was comparatively easy.

Wzrost profesjonalnych robotów przyspieszy 5G i edge AI chips niż chmura.

we base this prediction on the impact of two technological advancements: the improvements in wireless

connectivity made possible by 5G network technology, and the falling price and rising power of edge AI chips that can perform processor-intensive AI tasks on the actual robot, rather than through the cloud. The use of 5G and edge AI chips together can solve many challenges that limit professional service robots’ practicality today, making them more useful—and more attractive—to enterprise buyers.

5G ma zmienić w robotyzacji wiele z racji:

- 99.9999 percent (six nines) reliability rate, five minutes per year

- network slicing – allocates network performance to different tasks based on their priority

- latencies faster reaction times than LTE’s 40–50 milliseconds or Wi-Fi’s 100-plus milliseconds

- company may be able to control these costs by building a private 5G net work

Dlaczego bardziej zyskają profesjonalne roboty a nie przemysłowy? Przemysłowe na kablu.

Industrial robots today are usually connected to a wired factory network; they thus already have high-speed (if needed), ultra-reliable, low-latency connectivity, with minimal annual operating costs. They also have lots of space for extra chips to support machine learning, and their wired connection makes it easy for them to cheaply and reliably access more powerful remote processors if need be.

The edge AI chip industry appears ready for the challenge. Major manufacturers such as Intel, Nvidia, and Google (with more to follow) are already selling edge machine learning chips that cost less than US$100 and use less than 10 watts most of these are smaller than a postage stamp, with the largest about the size of a credit card. These chips are less powerful than the machine learning accelerators containing hundreds of chips that may be found in data centers at the network core, but they are quite capable of the kinds of on-board AI computations that enable professional service robots

to perform their tasks, even when connectivity is not available.

Kluczowe prywatne sieci 5G

The market for private 5G networks—many of which will almost certainly be used to connect robots—will also likely increase. Worth only a few hundred million dollars in 2020, private 5G installation spending by enterprises is expected to total billions of dollars in 2023 in Germany, a number of private 5G networks were already in use for professional service robots on production lines in 2019.

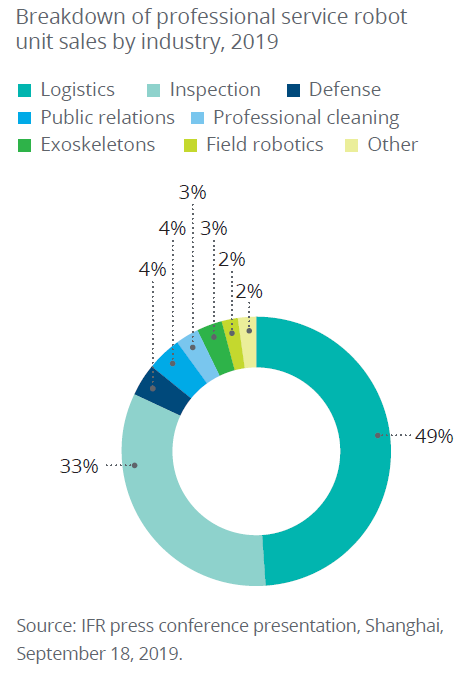

Jakie segmenty używają profesjonalnych robotów?

Just as the industrial robot sector is dominated by automotive and electronics, the professional service robot sector is dominated by logistics.

Just under half of the roughly 360,000 professional service robots sold to enterprises in 2019 went to logistics companies. Second and third place go to inspection and defense, which accounted for another 33 percent and 4 percent, respectively, of 2019’s professional service robot unit sales. Worth special mention is that, while medical robots made up less than 2 percent of the professional services robots sold in 2019, their high price—about half a million US dollars each in 2019—puts their collective price tag at US$3.7 billion, just under 30 percent of the professional service robot industry’s total revenues for that year.

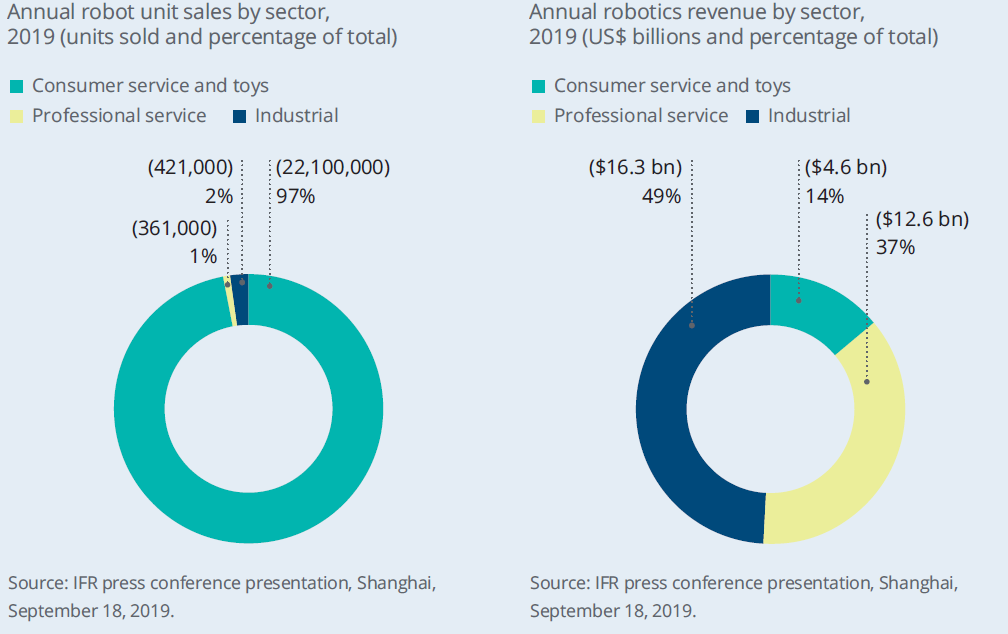

Consumer service robots, designed for tasks such as vacuuming, mowing the lawn, and washing windows, sold 17.6 million units in 2019, up 44 percent from 2018. And entertainment robots—mainly toys made in Asia, some of which are fairly sophisticated—sold 4.5 million units in 2019, 10 percent more than in 2018.

Although 97 percent of all of the robots sold each year are consumer robots, they are responsible for just one out of every seven dollars of robotics industry revenue.

Autorzy wskazują też ciekawy przypadek – robot pomagający pielęgniarkom. Artykuł na FastCompany tutaj.

Prywatne sieci 5G dla firm

Przewiduje się że prywatne sieci 5G będą popularne w przemyśle, centrach logistycznych oraz portach.

We expect that more than 100 companies worldwide will have begun testing private 5G deployments by

the end of 2020, collectively investing a few hundred million dollars in labor and equipment.

A survey by Gartner found that two-thirds of organizations planned to deploy 5G by 2020, predominantly for IoT communications and video. For more information, see: Gartner, “Gartner survey reveals two-thirds of organizations intend to deploy 5G by 2020,” press release, December 18, 2018.

In subsequent years, spend on private 5G installations, which may be single-site or spread across multiple locations, will climb sharply. By 2024, the value of cellular mobile equipment and services for use in private networks will likely add up to tens of billions of dollars annually.

W przemyśle kluczowe będzie funkcjonowanie sieci w otoczeniu metalowych przedmiotów – rozwiązuje to release 16 3gpp. This ability, which uses a Release 16 capability known as 5G CoMP (coordinated multi-point),is essential for industrial applications. If a metal object, such as a crane or conveyor belt, blocks a 5G signal’s path, the data can be sent via an alternative path. Multiple transmitters create redundant paths to the receiver, ensuring that the packet is delivered successfully.

Release 16 wesprze:

- Ultra-reliable low-latency communication(uRLLC)

- Massive machine-type communications (mMTC).

- incorporates support for timesensitive networking (TSN), which permits fixed Ethernet and 5G networks to coexist and converge. TSN will allow 5G networks to be used for

applications that are currently usually only carried over Ethernet wireline networks. - should include support for unlicensed networks, which means that private 5G deployments could use spectrum in unlicensed ranges.

5G będzie istnieć razem z kablowymi rozwiązaniami w fabryce. In the medium term (through 2026 or so), most companies will likely deploy 5G in combination with existing connectivity, including wired Ethernet networks. However, in the long term—over the next 10 to 15 years—5G may become the standard of choice in demanding environments, when flexibility is paramount, reliability is mandatory, or for installations that require massive sensor density.

We predict that about a third of the 2020–2025 private 5G market, measured in dollars of spend, will come from ports, airports, and similar logistics hubs, which we expect to be among the first movers. Another third of the total private 5G opportunity will come from factories and warehouses. The final third of the private 5G market will consist of greenfield installations, especially on campuses.

Pasma dla prywatnych 5G

- 5G in licensed spectrum. In this approach, which has been adopted in Germany, spectrum may be allocated to an individual company or managed by an operator

- LTE in licensed spectrum.

- Standalone LTE in unlicensed spectrum (MulteFire). This is the current approach in Japan, where the plan is to eventually migrate MulteFire to 5G NR.

- LTE in shared spectrum (e.g., Citizens Broadband Radio Service band [CBRS] in the United States). This operates at 3.5 GHz in the United States, where the US Federal Communications Commission has set up a three-tiered spectrum-sharing framework.

- Standalone 5G in unlicensed spectrum (MulteFire). One example is NR-U, with standalone and

nonstandalone modes of operation in the 5 GHz and 6 GHz bands.

High speed from low orbit: A broadband revolution or a bunch of space junk?

Coraz więcej satelit, również do transmisji danych.

We predict that by the end of 2020, there will be more than 700 satellites in low-earth orbit (LEO) seeking to offer global broadband internet, up from roughly 200 at the end of 2019. Though these won’t be enough to connect all of the world’s consumers and enterprises, they may offer partial service in late 2020 or early 2021, likely starting with higher latitudes.

To put this endeavor into perspective, consider that about 8,700 objects have been launched into space

since the start of the Space Age, of which more than 2,000 are actively operating satellites orbiting the

earth. These new “megaconstellations” of orbiting broadband stations will potentially add more than 16,000 individual satellites to that count over the coming years. The world may derive a historic benefit from their deployment—but at the same time, they might make space a much riskier and complex environment.

Rodzaje orbit:

Low-earth orbit (LEO): An orbit between 160 and 2,000 kilometers above the earth. Low-earth orbits

have a short orbital period (approximately 90 to 120 minutes) and are commonly used for remote

sensing, human space flight, and data communication.2 Satellites in this orbit can only communicate

with a small portion of the earth’s surface at any given moment, which is why a larger number of

satellites are needed for global coverage.

Medium-earth orbit (MEO): A less-popular orbit between 2,000 and 35,786 kilometers above the

earth. Satellites in this orbit can see more of the earth than LEO-based satellites, and they enable

lower latencies than higher satellites. This orbit is used by both positioning (such as Global Positioning

System) and communications satellites.

Geosynchronous orbit (GEO): An orbit at 35,786 km above the earth’s surface. Satellites in this orbit

move at the same speed that the Earth is rotating, so they stay in roughly the same place over the

earth’s surface. With a much wider view of the earth, this orbit is good for imagery, communications,

and weather satellites, because only a few satellites can provide global coverage. To connect with GEO

satellites, ground-based antennas can remain fixed at one point in the sky rather than needing to

track a moving object.

Frequency: range from the lower-frequency L- (1–2 GHz) and S- (2–4 GHz) bands to the higher-frequency Ku- (12–18 GHz), Ka- (26–40 GHz), and V- (40–75 GHz) bands. Each frequency range has its advantages, disadvantages and specific use cases.

Latency: Currently, satellite broadband services have median latencies of around 594 to 612 milliseconds. Latencies for terrestrial broadband (using technologies such as fiber, cable, or DSL)

range from 12 to 37 milliseconds. The goal for future 5G networks is a latency as low as 1 to 2

milliseconds, although this will likely take years to achieve.

Morgan Stanley estimates that the satellite broadband market could be worth as much as US$400

billion by 2040—fully 40 percent of the estimated US$1 trillion global space industry that year.

Several commercial satellite internet service providers—Viasat, Eutelsat, Hughes, Iridium, O3b Networks, and others—have been operating constellations across different orbits for years.

Three enablers:

- Getting into orbit has become less expensive. Launch and satellite construction costs have decreased dramatically since the turn of the century, thanks to new launch services and heavier competition. Between 1970 and 2000, the average cost of launching an object into orbit was

about US$18,500 per kilogram. With the advent of new launch providers such as SpaceX and others, companies can now put a kilo into orbit for about US$2,720, or about 85 percent less. Equally important to improving launch economics is the fact that today’s satellites weigh less.14 For example, the original Iridium satellites launched in the late 1990s weighed 689 kilograms each, while today’s Starlink satellites (from SpaceX) weigh only 227 kilograms. - Satellites and their manufacturing methods are becoming more advanced. companies are using a more modular design for these individual satellites, building them on standardized buses, and using smaller, more advanced components. Many are also using electrical propulsion systems which trade strength for reduced weight and lower cost.

- The demand for connectivity has increased. Besides the billions of unserved and

underserved individuals in the world’s remote or less-developed areas, demand is also being

driven by growing expectations.

Główne podmioty: A number of companies from the United States, Canada, China, Russia, and Europe are trying to establish themselves in the satellite broadband market. As of November 2018, in the United States, the FCC had granted thirteen market access requests and nine satellite applications for broadband internet constellations, to companies including Telesat, Kepler, LeoSat, SpaceX,

OneWeb, SES (O3b), Space Norway, and others. More recently, in July 2019, Amazon applied for

FCC approval to deploy its Kuiper satellite system.

Pozostałe trendy w raporcie:

- The smartphone multiplier: Toward a trillion-dollar economy

- My antennae are tingling: Terrestrial TV’s surprising staying power

- Coming to a CDN near you: Videos, games, and much, much more

- Ad-supported video: Will the United States follow Asia’s lead?

- The ears have it: The rise of audiobooks and podcasting

- Cycling’s technological transformation: Making bicycling faster, easier, and safer

Comments

Comments are disabled for this post